Weekly Breakdown for the Week of July 7-11, 2025

Bitcoin Climbs to New All-Time Highs

Bitcoin (BTC) rose to a new all-time high this week, reaching around $118,000, as investor interest surged following the largest bitcoin ETF inflow of 2025, at $1.18 billion.

Ether (ETH) also rallied 6 percent, reclaiming the $3,000 level, supported by $383 million in ETF inflows.

The momentum began after the release of Federal Reserve minutes showed mixed views on interest rate cuts, leading traders to anticipate a more dovish stance from future Fed leadership.

Institutional buying, rising tech stocks, and expectations of increased federal spending have added to the bullish sentiment. A wave of short liquidations further fueled the price move, with over $550 million in bitcoin shorts closed over a 24-hour period.

Bitcoin is on track for a weekly gain of nearly 10 percent, while ether is up more than 21 percent.

ProKidney Surges on Phase 2 Trial Results

ProKidney Corp. (PROK) surged over 500% following the announcement of promising Phase 2 trial results for its chronic kidney disease treatment, rilparencel, which showed a 78% improvement in kidney function for one patient group.

However, the stock remains over 70% below its 2023 peak, and while analysts see potential, price targets suggest the stock is fairly valued.

The company has ample cash reserves and low debt, but continues to burn through capital without any revenue-generating products.

Risks remain high due to dependence on a single drug candidate, uncertainty around Phase 3 trial success, and extreme stock volatility.

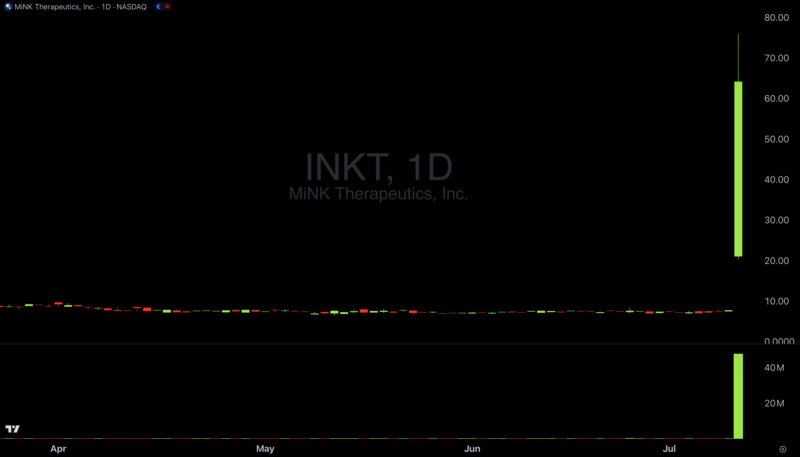

MiNK Therapeutics Squeezes on Clinical Results

MiNK Therapeutics (INKT) shares soared as high as 700% on Friday after the company reported clinical results for its allogeneic iNKT cell therapy, agenT-797.

A landmark case published in Nature’s Oncogene described a patient with treatment-resistant metastatic testicular cancer who achieved a complete and lasting remission over two years after a single infusion of agenT-797 combined with Opdivo.

The therapy was well-tolerated with no serious side effects. Additional Phase 2 trial data in gastric cancer showed promising signs of immune activation and tumor control, with some patients surviving over 12 months.

These developments have boosted investor interest and trading volume.

Q2 Earnings Season Preview

As investors prepare for Q2 earnings season, the market’s strong rally since early April faces its next major test.

While S&P 500 (SPY) revenue estimates for Q2 have remained stable, earnings expectations have declined notably, with margin pressure likely to be a central theme.

EPS forecasts have improved slightly in the past month, but still fall short of earlier projections, creating a low bar that companies may be able to exceed.

Technology stands out as the only sector with positive EPS revisions for both Q2 and full-year 2025, while Energy continues to see sharp downgrades. The full-year outlook suggests modest EPS downgrades, with growth expectations pushed to the second half.

Analysts stated that focus should be placed on how companies manage margins and whether forward guidance supports a rotation into value and cyclical stocks, which have lagged but recently shown signs of strength.

Q2 results and stock reactions will be key in determining if leadership broadens beyond the tech-heavy rally, making it critical to watch earnings surprises, margin trends, and sector performance in the coming weeks.

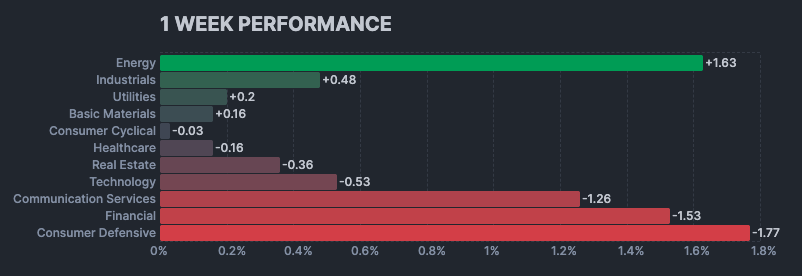

Sector Weekly Performance

Current Themes & Volatile Movers

Headline Reactions

News catalysts of all types caused sharp reactions in many stocks this week.

ASST up 50% this week after the company announced it entered an amended merger agreement with Strive Enterprises.

CORZ down 9% this week after CRWV announced it will acquire the company in an all-stock deal. Core Scientific shareholders will receive 0.1235 newly issued shares of CRWV for each share of CORZ stock based on a fixed exchange ratio.

TSLA up 7% this week after no recourse was brought forward from the Trump administration after Elon Musk formed a new political party.

BMNR down 65% this week after the company filed for a mixed shelf “At The Market Offering” prospectus for up to $2B in common stock that may be issued from time to time.

GSAT up 6% this week after the company announced it signed an agreement with SpaceX to provide satellite services for the launch of Falcon 9.

OKLO up 5% this week after Cathie Wood’s Ark said that nuclear may now be the cheapest energy option.

ARM down 4% this week amid trade tensions between the US and several Asian countries.

QS up 35% this week on optimism regarding the company’s solid state battery technology for electric vehicles.

SOUN up 8% this week as momentum in small cap AI stocks continued amid recent volatility in BBAI.

DDOG down 11% this week after Guggenheim downgraded the stock to a Sell rating.

INTC up 5% this week after announcing job cuts as part of a broader layoff plan.

BAC down 4% this week after the company received a downgrade from HSBC.

FCX up 2% this week after 50% copper tariffs were stated to be going into effect.

MRNA up 11% this week after the company stated that it will sue RFK Jr. over what the company deems to be unlawful Covid-19 vaccine rollbacks.

DVN up 3% this week as energy related stocks saw broad momentum.

FSLR down 9% this week after Trump made disparaging remarks about the solar industry during a press conference on Tuesday.

BA up 5% this week after Susquehanna raised its price target on the stock to $252.

HIMS up 3% this week after the company announced it plans to expand into Canada by 2026.

NVDA up 4% this week as the company crossed a $4T market cap for the first time on Wednesday. The company also announced it will launch an AI chip for the Chinese market that will be compatible with regulations.

VRNA up 16% this week on reports that the company is near a deal to be acquired by MRK for $10B.

PTC up 10% this week on reports that Autodesk is weighing a takeover of the firm.

CLSK up 9% this week on cryptocurrency price strength.

BABA down 2% this week after Jefferies lowered its price target on the stock. Also, the company completed an offering of HK$12B of zero-coupon exchangeable bonds.

CRWV down 20% this week after announcing its proposed acquisition of CORZ and Needham downgraded the stock to a Hold rating.

COIN up 9% this week after the company announced it partnered with Perplexity AI. Also, Bitcoin hit new all-time highs.

AMD up 7% this week after HSBC upgraded the stock to a Buy rating and announced a $200 price target.

VRT down 3% this week amid a report suggesting that AWS will begin using its own chips for a liquid cooling system.

SBET up 51% this week after the company announced it purchased 10,000 units of Ethereum.

OSCR down 11% this week after Wells Fargo downgraded the stock to Underweight and cut its price target to $10.

BBAI down 13% this week as momentum slowed in the stock on no particular news.

PYPL down 6% this week after JPM stated fintech companies will have to pay for customer data.

KHC up 2% this week after the company announced it’s preparing to spin off its grocery business into an independent entity worth up to $20B.

MSTR up 9% this week after bitcoin rallied to a new all-time high of $118,900 on Friday.

NOW down 10% this week as several software companies faced selling pressure on Friday.

CRCL down 2% this week despite Baird initiating coverage on the stock with a $210 price target.

Earnings Reactions

Earnings reports brought volatility to many individual stocks, with forward guidance being a significant driver of earnings reactions.

Up on Earnings

DAL up 11% this week after the company reported better-than-expected Q2 EPS and sales results.

Down on Earnings

TEAM down 12% this week after the company reported worse-than-expected financial results.

Market & Economic News

The White House informed multiple countries what their respective tariff rate with the US will be if a deal is not completed prior to August 1. Most ranged from 25%-40%.

Consumer credit data fell short of expectations on Tuesday, dropping to $5.10B vs $10.4B estimates.

SpaceX’s valuation is said to be nearly $400B after its latest planned share sale.

FOMC minutes confirmed that most Fed members see rate cuts this year, but there was no consensus on the timing.

Bitcoin made new all-time highs of $116K on Thursday.

The Pentagon fast-tracked unmanned aircraft production.

Pulte made comments that Fed Chair Powell is considering resigning, although claims were not backed by confirmed reports.

Musk’s xAI is seeking a $200B valuation in its next funding round.

Upcoming Earnings

Monday 7/14/25

FAST, SLP, EQBK, FBK

Tuesday 7/15/25

JPM, JBHT, C, HWC, BLK, STT, BK, ANGO, OMC

Wednesday 7/16/25

ASML, UAL, BAC, AA, PGR, SLG, JNJ, MS, TFIN, FR, MS, PNC, MTB

Thursday 7/17/25

TSM, NFLX, IBKR, CATS, MRTS, OZK, ABT, PEP, USB

Friday 7/18/25

HBAN, MMM, RF, TFC, SLB, AXP, SCHW, ALLY, CMA, ALV

Upcoming Economic Events & Data

Monday 7/14/25

6-Month Bill Auction

Tuesday 7/15/25

Core Inflation Rate

Inflation Rate

CPI

NY Empire State Manufacturing Index

Redbook

Wednesday 7/16/25

PPI

Core PPI

Industrial Production

Manufacturing Production

Fed Beige Book

Thursday 7/17/25

Retail Sales

Initial Jobless Claims

Continuing Jobless Claims

Philly Fed Manufacturing Index

Business Inventories

NAHB Housing Market Index

Friday 7/18/25

Building Permits

Housing Starts

Michigan Consumer Sentiment

Michigan 5-Year Inflation Expectations