Weekly Breakdown for the Week of July 28 – August 1, 2025

New Tariff Plans Rattle Market

President Trump has announced updated tariff rates affecting over 65 countries and the European Union, with many of the changes reflecting earlier statements or recent trade agreements.

Although the administration had previously stated that tariffs would take effect on August 1, most will begin a week later.

Countries not listed in the new order will face an additional 10% tariff, while specific measures include a 35% tariff on certain Canadian goods due to concerns about drug trafficking, a pause on new Mexican tariffs amid ongoing talks, and continued application of earlier tariffs on China.

An additional 40% tariff will apply to transshipped goods intended to bypass U.S. trade rules.

US markets slumped on Friday in response to the plan, with SPY falling by 2% on the week.

Microsoft’s Azure Takes the Spotlight on Earnings

Microsoft (MSFT) shares rose over 5% on Thursday after the company reported stronger-than-expected earnings, pushing its market value above $4 trillion and joining Nvidia (NVDA) in that milestone.

The tech giant posted 18% revenue growth, which is its fastest in more than three years, fueled largely by its Azure cloud computing business.

For the first time, Microsoft revealed Azure revenue in dollar terms, reporting over $75 billion in sales from Azure and related cloud services in fiscal 2025, a 34% increase from the previous year.

Meta Doubles Down on AI

Meta (META) CEO Mark Zuckerberg announced that the company will continue its significant investment in artificial intelligence through next year, driven by the fast pace of AI development.

This includes a $14.3 billion investment in the data-annotation firm Scale AI and the creation of a highly skilled AI Superintelligence team to develop tools that can be applied across Meta’s platforms, including Facebook and Instagram.

As a result, Meta raised its 2025 expense forecast to a range of $114 billion to $118 billion and said AI efforts will lead to even higher expense growth in 2026.

Other tech giants like Alphabet (GOOGL) and Microsoft (MSFT) are also increasing their AI spending.

Despite high costs, Meta’s stock rose nearly 12 percent following strong second-quarter earnings and optimistic sales guidance.

AI has already improved the company’s ad systems, helping reassure investors. Meanwhile, losses in Meta’s Reality Labs division continue, though interest in the Ray-Ban Meta smart glasses has eased concerns.

Apple Receives Mixed Reaction to Earnings Report

Apple (AAPL) reported stronger-than-expected third-quarter earnings, with revenue rising 10 percent and iPhone sales increasing 13 percent year over year, marking its highest revenue growth since late 2021.

The company beat Wall Street estimates across most major categories, including services and Mac sales, though iPad and wearables revenue declined.

CEO Tim Cook attributed part of the revenue growth to customers purchasing ahead of potential tariffs and noted strong iPhone 16 performance.

Apple also saw a return to growth in China, helped by government subsidies.

The company expects continued revenue and services growth, with gross margins between 46 and 47 percent.

Cook emphasized Apple’s growing investment in artificial intelligence, saying it is being integrated across devices and platforms, and expressed openness to mergers and acquisitions that support this effort.

Amazon Falls on Weaker Profit Outlook

Amazon (AMZN) reported second-quarter earnings that exceeded expectations across several metrics, including strong revenue, 11 percent growth in online store sales, and a 23 percent rise in advertising revenue.

However, the company’s

weaker profit outlook and slower cloud growth compared to rivals led to an 8 percent drop in its stock.

Amazon’s capital expenditures surged to $31.4 billion in the quarter, signaling increased investment in AI infrastructure, with projections of up to $118 billion for the year.

CEO Andy Jassy noted early benefits from AI but provided few specific outcomes. While AWS remains the largest cloud provider, its 18 percent growth trailed Microsoft (MSFT) and Google (GOOGL), raising investor concerns about competitiveness.

On tariffs, Amazon appears to be managing trade tensions with China better than expected, with minimal impact on pricing or demand so far. Jassy remained cautious about future tariff effects, noting ongoing uncertainty in U.S.-China trade negotiations.

Figma’s IPO Launch Helps to Reignite the IPO Market

Figma’s (FIG) stock more than tripled in its debut on the New York Stock Exchange, closing at $122 at the end of the week after being priced at $33 in its initial public offering, giving the company a market value of nearly $70 billion.

This surge marks a strong signal that the tech IPO market is rebounding after a slowdown that began in 2022.

Figma, known for its web-based design and collaboration tools, has over 13 million monthly users and major clients like Google (GOOGL), Microsoft (MSFT), and Netflix (NFLX).

The company posted up to $12 million in operating income on revenue nearing $250 million in the second quarter, with 40 percent year-over-year growth.

Most of the $1.2 billion raised in the IPO went to existing shareholders.

CEO Dylan Field emphasized the need to stay focused despite the hype, and NYSE President Lynn Martin suggested that Figma’s successful launch could lead to more IPOs in the near future.

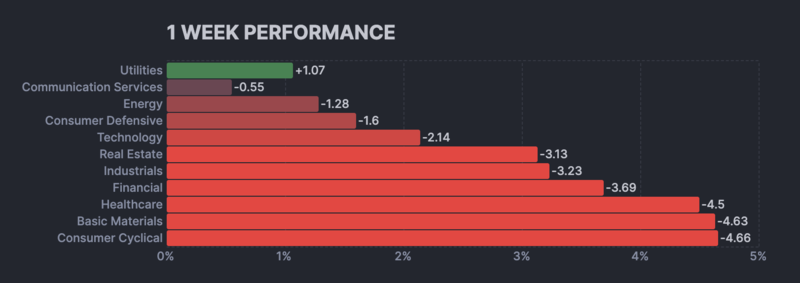

Sector Weekly Performance

Current Themes & Volatile Movers

Headline Reactions

News catalysts of all types caused sharp reactions in many stocks this week.

SRPT up 31% this week following news that the FDA recommended the company resume shipments of Elevidys for ambulatory individuals with Duchenne Muscular Dystrophy.

BMNR down 22% this week after the company filed a prospectus to register shares and warrants for resale by investors from a June 2025 PIPE deal.

CELC up 170% this week after the company released top-line results from the PIK3CA Wild-Type cohort of Phase 3 VIKTORIA-1 trial.

QS down 30% this week on continued selling pressure following recent negative analyst comments.

LLY down 6% this week after NVO cut its 2025 guidance amid weaker weight-loss drug sales in the US.

CYBR up 9% this week following a report suggesting PANW would acquire the company for over $20B.

REPL up 141% this week amid Vinay Prasad’s departure as director of the FDA’s Center for Biologics Evaluation and Research.

FCX down 10% this week after Trump signed a proclamation imposing universal 50% tariffs on imports of semi-finished copper products and copper-intensive derivative products, effective August 1st. The price of copper fell 17% on the news.

PANW down 15% this week after the company announced it will acquire CYBR.

CRWV down 9% this week despite a bounce in the stock as AI stocks spiked in response to large tech earnings and capex announcements.

LLY down 2% this week after Trump posted a letter calling for pharma companies to lower prices within the next 60 days.

SNOW down 8% as AMZN earnings and AWS results weighed on the stock.

Earnings Reactions

Earnings reports brought volatility to many individual stocks, with forward guidance being a significant driver of earnings reactions.

Up on Earnings

GNRC up 23% this week after the company reported better-than-expected Q2 financial results.

EBAY up 18% this week after the company reported earnings results and received multiple price target increases.

RDDT up 25% this week after the company reported better-than-expected Q2 financial results and issued Q3 sales guidance above estimates.

TER up 13% this week following the release of better-than-expected EPS and sales results.

HUM up 4% this week after the company reported better-than-expected financial results.

SOFI was mixed this week after reporting financial results and raising its 2025 sales guidance. However, shares fell after the company announced an offering of common stock.

Down on Earnings

CMG down 7% this week on continued selling after recently receiving multiple price target cuts following a poor earnings quarter.

NVO down 32% this week after the company reported financial results and lowered its 2025 sales outlook, citing reduced growth expectations for Wegovy and Ozempic in the US and weaker Wegovy penetration.

SPOT down 10% this week after missing on EPS and sales estimates.

UNH down 15% this week after reporting financial results, missing on EPS and revenue estimates, and receiving price target cuts.

UPS down 17% this week after the company reported a Q2 adjusted EPS miss.

EMN down 24% this week after the company reported worse-than-expected Q2 financial results and issued Q3 EPS guidance below estimates.

FLR down 27% this week after the company reported below-estimate earnings and lowered its FY25 EPS guidance amid infrastructure delays.

COIN down 19% this week following the report of its quarterly financials that missed EPS and sales estimates.

MSTR down 10% this week after reporting earnings as bitcoin fell to $113,000 on Friday.

RCL down 10% this week after the company issued Q3 sales guidance below estimates despite raising FY25 guidance.

Market & Economic News

US Consumer Confidence data rose on Tuesday, beating expectations and previous numbers.

Trump to decide on a US-China trade truce extension soon.

The Federal Reserve left interest rates unchanged on Wednesday while traders bet on cuts for September and later in the year.

Trump stated that a trade deal with South Korea has been reached.

The White House is reported to be expanding price support for rare earth projects, according to Reuters.

The US added 73,000 jobs in July, falling short of estimates. This data shifted Fed rate-cut odds in September higher.

Fed Governor Kugler will resign in early August.

Trump ordered nuclear submarines to be positioned near Russia.

Upcoming Earnings

Monday 8/4/25

BRK, PLTR, HIMS, W, BNTX, MELI, ON, AXON, ON, NVTS, VRTX, IEP, TSN

Tuesday 8/5/25

PFE, AMD, CAT, SMCI, BP, ANET, DUK, ALAB, LMND, OPEN, SNAP, DD, LCID, ETN, UPST, RIVN, MAR

Wednesday 8/6/25

UBER, APP, SHOP, IONQ, SYM, OSCR, NVO, DOUL, DIS, FTNT, ET, ELF, DKNG, GEO, JACK, JOBY, MCD

Thursday 8/7/25

QBTS, TTD, RKLB, LLY, CELH, HUT, SMR, KTOS, VST, XYZ, PINS, ESTA, TEAM, SONY, UUUU, TWLO

Friday 8/8/25

FUBO, TEM, WULF, FET, WEN, CGC, PAA, PAR, PMTS, SLVM

Upcoming Economic Events & Data

Monday 8/4/25

Factory Orders MoM

Total Vehicle Sales

Tuesday 8/5/25

Balance of Trade

Exports

Imports

ISM Services PMI

3-Year Note Auction

Wednesday 8/6/25

MBA Mortgage Applications

MBA Purchase Index

EIA Crude Oil Stocks Change

Thursday 8/7/25

Initial Jobless Claims

Nonfarm Productivity

Continuing Jobless Claims

Consumer Inflation Expectations

30-Year Bond Auction

Consumer Credit Change

Friday 8/8/25

Baker Hughes Oil Rig Count