Weekly Breakdown for the Week of August 4-8 2025

Apple’s Latest Investment in the US Could Reduce Tariff Risks

Investors are becoming increasingly optimistic that Apple (AAPL) has eased tariff tensions with the Trump administration after announcing an additional $100B investment in U.S. operations.

This is seen as a move aimed at avoiding a proposed 100% tariff on semiconductor imports.

The investment, while costly, is seen as a better alternative to higher tariffs and could pave the way for a stronger iPhone production cycle this fall.

Analysts raised price targets on the stock following the announcement, noting the decision removes a major tariff risk.

Although Apple’s shares remain down about 5% this year due to its reliance on overseas production and lingering doubts about its AI strategy, the tariff relief is viewed as a significant step toward stabilizing its core business.

Palantir Has Blowout Quarter

Palantir (PLTR) shares jumped nearly 16% this week after the company posted record quarterly results and raised its full-year outlook, fueled by strong demand for its AI-driven software.

Quarterly revenue surged 48% to over $1 billion, topping analyst expectations, with U.S. revenue up 68% and U.S. commercial revenue nearly doubling.

Government contracts also grew sharply, aided by President Trump’s efficiency push. Net income more than doubled to $326.7 million, while adjusted earnings beat forecasts at 16 cents per share.

The company now expects full-year revenue between $4.142 billion and $4.150 billion, up from prior guidance. Shares have soared over 120% in 2025, pushing its market cap above $400 billion.

Markets React to Next Fed Chair Candidates

The White House has significantly expanded its search for a successor to Federal Reserve Chair Jerome Powell, widening the candidate pool to about ten people.

New names under consideration include former St. Louis Fed President James Bullard and economist Marc Sumerlin, alongside previously mentioned contenders such as Kevin Hassett, Kevin Warsh, and current Fed Governor Christopher Waller.

Trump has also nominated his economic adviser Stephen Miran to fill the immediate vacancy on the Fed Board following the early resignation of Governor Adriana Kugler, a move that, if confirmed, would give him flexibility while continuing to evaluate long-term candidates.

SPY rallied on Miran’s appointment to fill the vacancy, as a Trump-friendly appointee to the Fed board could shape a lower interest rate policy aligned with the administration’s goals in the near future.

US & India Argue Over Tariffs

India has paused talks to buy U.S. defense equipment, including Stryker combat vehicles, Javelin missiles, and Boeing P8I aircraft, amid heightened tensions with Washington over new tariffs imposed by President Trump.

The tariffs, which doubled duties on Indian goods to 50%, were introduced as punishment for India’s continued purchases of Russian oil.

While New Delhi says defense procurement could resume once there is clarity on tariffs and bilateral ties, the planned trip by India’s defense minister to finalize deals has been canceled.

India, which has been shifting from Russian to Western arms suppliers in recent years, maintains that it is being unfairly targeted, especially as Western nations continue selective trade with Moscow.

Although India remains open to reducing Russian oil imports and strengthening defense ties with the U.S., rising anti-U.S. sentiment and political sensitivities have slowed progress, with the broader defense partnership still intact for now.

Eli Lilly Shares Tumble on Below Estimate Data

Eli Lilly (LLY) shares fell 18% this week, the largest drop in decades, after late-stage trial results for its obesity pill orforglipron showed average weight loss of just over 12% in non-diabetic patients.

This number was below Wall Street’s 15% expectation and trailed rival Novo Nordisk’s (NVO) 15% results for its oral Wegovy treatment.

Eli Lilly emphasized the drug’s cardiovascular benefits and expressed confidence in its potential, but the weaker-than-expected data pushed Novo Nordisk shares up more than 7%.

The company still plans to seek regulatory approval for orforglipron by year-end as it looks to compete in the growing weight-loss pill market currently led by injectable drugs like Ozempic and Wegovy.

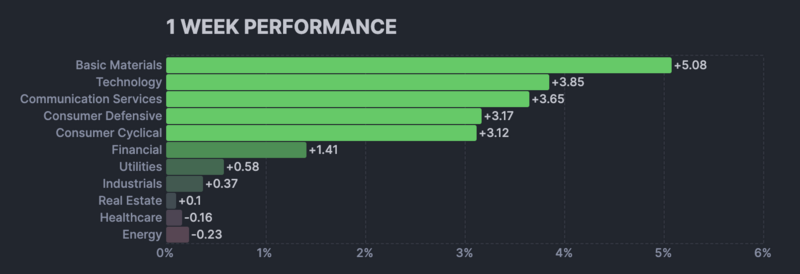

Sector Weekly Performance

Current Themes & Volatile Movers

Headline Reactions

News catalysts of all types caused sharp reactions in many stocks this week.

NVDA up 4% this week after Elon Musk highlighted xAI’s growth potential being higher than META.

COMM up 85% this week after APH announced it will acquire the company for $10.5B.

AEO up 9% this week after President Trump praised Sydney Sweeney’s recent advertisement with the company.

FIG down 27% this week as momentum slowed in the stock after the oversubscribed IPO debut last week.

RGTI up 5% this week after Needham raised its price target on the stock to $18.

HOOD up 16% this week as crypto prices recovered part of the sell-off from the past weekend as markets rallied.

PBR down 5% this week after the company announced a lower probability of an additional dividend payment this year.

MU up 11% this week as strong momentum in AI-related stocks persisted.

FNMA up 11% this week on reports of the Trump Administration allowing an IPO of the mortgage company to happen later this year.

Earnings Reactions

Earnings reports brought volatility to many individual stocks, with forward guidance being a significant driver of earnings reactions.

Up on Earnings

JOBY down 16% this week after the company reported financial results and announced it will acquire Blade’s passenger division for $125M.

AMD flat this week after releasing mixed Q2 financial results, and the CEO stated that AI chip revenue in the data center segment declined year-over-year.

DUOL up 7% this week following the release of the company’s financial results that beat on earnings and sales and raised forward guidance.

APP up 20% this week after reporting financial results and in-line guidance estimates.

ANET up 17% this week after the company reported better-than-expected financial results and multiple analysts raised price targets on the stock.

SHOP up 21% this week after beating earnings and sales estimates as US demand remained strong.

SOUN up 32% this week after reporting financial results and launching Vision AI, bringing real-time visual understanding to its conversational platform.

Down on Earnings

ON down 9% this week after the company reported Q2 financial results.

VRTX down 21% this week after releasing Q2 financial results. Additionally, the company announced results from its Vx-993 Phase 2 trial, and several investment firms lowered their price targets on the stock.

SMCI down 23% this week after the company reported worse-than-expected Q4 financial results, issued forward guidance below estimates, and cut its FY26 sales guidance.

UPST down 14% this week following the release of its quarterly financial results.

RIVN down 5% this week after releasing worse-than-expected earnings, and the CEO said that the company expects higher operating expenses in the second half of the year.

HIMS down 18% this week after the company reported a sales miss and NVO expanded legal action to protect patients from non-FDA-approved weight-loss drugs.

SNAP down 19% this week after reporting financial results and receiving multiple price target cuts from analysts.

TTD down 38% this week after the company reported financial results and announced new senior leadership changes. The company also received multiple price target cuts from investment firms.

WBD down 15% this week after the company announced financial results and received mixed analyst reactions.

GDDY down 14% this week after the company reported financial results and received several price target cuts.

Market & Economic News

The Fed’s Daly signaled readiness to cut rates amid soft job market data.

India stated that US and EU criticisms of Russian oil imports are unjustified.

OpenAI released open-weight AI models to compete with DeepSeek.

The US proposed new rules to expand commercial drone operations.

Fed member Cook called July’s jobs data “concerning” amid a US hiring slowdown.

Trump is said to be nearing a meeting with Putin and Zelenskiy over a ceasefire agreement.

The White House stated it will clarify comments regarding tariffs on gold bars.

The WSJ reported that Trump’s team is expanding the search for the next Fed Chair and added Bullard and Sumerlin to the list.

Upcoming Earnings

Monday 8/11/25

MNDY, BBAI, OKLO, B, VFF, AMC, FNV, ASTS, PLUG, GPRO

Tuesday 8/12/25

CRCL, CRWV, SE, RGTI, PONY, CAVA, KOPN, GRAL, ONON, AUTL

Wednesday 8/13/25

ARCO, CSCO, EAT, EQX, ASM, INVZ, SURG, ELVA, ALVO, SARO

Thursday 8/14/25

AG, AMAT, JD, NU, DE, KULR, AMCR, TMC, CAN, SNDK, AAP, XXII

Friday 8/15/25

FLO, FUFU, VNRX

Upcoming Economic Events & Data

Monday 8/11/25

6-Month Bill Auction

Tuesday 8/12/25

Inflation Rate YoY

Core Inflation Rate YoY

CPI

Redbook YoY

Wednesday 8/13/25

MBA Purchase Index

EIA Crude Oil Stocks Change

Fed Goolsbee Speech

Thursday 8/14/25

PPI MoM

Core PPI MoM

Initial Jobless Claims

Continuing Jobless Claims

Fed Balance Sheet

Friday 8/15/25

Retail Sales MoM

NY Empire State Manufacturing Index

Industrial Production

Manufacturing Production

Michigan Consumer Sentiment

Michigan 5-Year Inflation Expectations