Weekly Breakdown for the Week of June 16-20, 2025

Circle Goes Parabolic on GENIUS Act

Shares of Circle (CRCL) surged nearly 80% this week after the Senate passed the GENIUS Act, a bill that would establish a regulatory framework for stablecoins.

The legislation sparked major investor enthusiasm, sending Circle’s stock up 33% on Wednesday and over 20% on Friday.

The broader interest in stablecoins, which are pegged to assets like the U.S. dollar, is increasing as major companies such as Amazon (AMZN), Walmart (WMT), Apple (AAPL), and Uber (UBER) explore their use.

The GENIUS Act is viewed as a potential game-changer for the U.S. payments infrastructure, offering faster settlements, greater transparency, and stronger consumer protections, while promoting both traditional finance and cryptocurrency adoption.

Coinbase Eyes Payment Rails Market Share

Coinbase’s (COIN) growing role in stablecoin-based payments, especially through its involvement with USDC, poses a serious long-term threat to traditional credit card giants like Visa (V) and Mastercard (MA).

With the GENIUS Act paving the way for clearer regulation, stablecoins are gaining legitimacy, and Coinbase is positioned to capitalize by offering near-instant, low-cost transactions that bypass the traditional card networks.

Unlike Visa and Mastercard, which typically charge merchants 2 -3% in transaction fees and take days to settle payments, Coinbase can offer real-time settlement with fees that are a fraction of a cent.

If large platforms adopt stablecoin payments via Coinbase or similar blockchain infrastructure, it could significantly reduce demand for legacy card rails.

Research from firms like ARK Invest and Bernstein suggests that crypto-based payment networks could reduce processing costs by up to 90%, posing a structural threat to Visa and Mastercard’s long-standing dominance in the global payments ecosystem.

Solar Slumps on Removal of Clean-Energy Tax Credits

Solar stocks plunged after the Senate upheld the full removal of clean-energy tax credits in its budget bill, despite slightly extending the phaseout timeline compared to the House version.

Citi analysts reaffirmed their bearish stance on residential solar, predicting sharp declines in names like SunRun (RUN) and Enphase (ENPH) due to the stricter-than-expected policy shift.

On Tuesday, SunRun fell nearly 40% and Enphase slid 23%.

Citi also warned that the bill poses significant challenges for energy storage companies, with the overall legislation viewed as substantially more restrictive than earlier proposals.

Fed Holds Rates Steady Amid Inflation Uncertainty

The Federal Reserve held interest rates steady at 4.25% – 4.5% this week, signaling caution amid persistent inflation and slowing economic growth.

While officials still anticipate two rate cuts by the end of 2025, projections for future years were scaled back, reflecting ongoing uncertainty.

Inflation and unemployment forecasts were revised upward, and GDP expectations were trimmed.

Fed Chair Jerome Powell emphasized a wait-and-see approach, citing reduced but still elevated economic uncertainty, including geopolitical risks and the impact of tariffs.

President Trump continued to criticize the Fed, pushing for deeper cuts to ease the burden of rising interest costs on the federal government’s $36 trillion debt.

Markets remained largely flat, and analysts noted the Fed appears to be waiting for clear signs, either inflation from tariffs or weakness in the labor market, before making further policy moves.

Oil Remains Volatile on Middle East Concerns

Oil prices fell on Friday but still ended the week higher, as new U.S. sanctions on Iran were viewed as part of a diplomatic approach rather than an escalation, which helped calm market fears.

Brent crude dropped 2.3% for the day but rose 3.6% for the week, while U.S. crude futures increased by 2.7%. Tensions spiked earlier in the week after military strikes between Israel and Iran, raising concerns about possible supply disruptions.

Although oil exports have not been affected so far, analysts have warned that any direct hit to infrastructure or shipping routes, such as the Strait of Hormuz, could push prices up to $100 per barrel.

In other developments, the European Union abandoned its proposal to lower the price cap on Russian oil, and U.S. oil and gas rigs fell for the eighth consecutive week, reaching their lowest level since 2021, signaling a potential slowdown in future production.

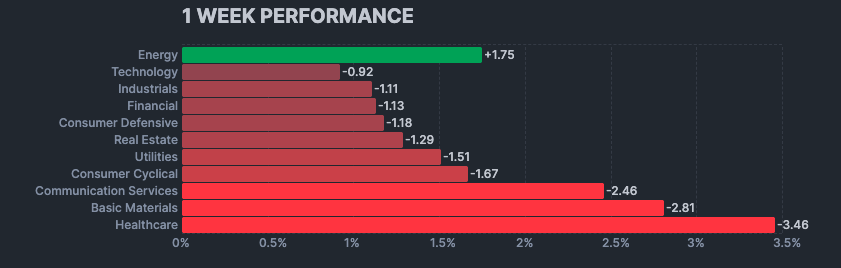

Sector Weekly Performance

Current Themes & Volatile Movers

Headline Reactions

News catalysts of all types caused sharp reactions in many stocks this week.

SRM up 895% this week after the company entered a securities purchase agreement with a private investor for a $100M equity investment, which it will use to initiate a TRON token treasury strategy.

AMD up 10% this week after Piper Sandler raised its price target on the stock to $140.

QUBT up 10% this week as momentum in quantum-related companies continued after recent comments from NVDA CEO Jensen.

RGC up 135% this week after the company completed a 38-for-1 forward stock split.

LMT down 2% this week as defense stocks were mixed amid speculative reports that Iran may seek to de-escalate.

CRWV up 26% this week after B of A Securities raised its price target on the stock to $185.

VERV up 80% this week after LLY agreed to acquire the company for $10.50 per share in cash plus one contingent value right of up to an additional $3 per share.

RDDT up 21% this week following a recent report that the company launched two new AI-powered advertising features.

TMUS down 2% this week after SoftBank was reported to be selling $4.4B worth of shares soon.

ADBE down 4% this week after Citigroup lowered its price target on the stock.

MRVL up 7% this week after announcing a collaboration with Empower Semiconductor on next-generation integrated power solutions for AI and cloud platforms.

LSE up 21% this week on a possible short covering rally following recent volatility in the stock.

TMC up 41% this week on continued momentum from a recent investment from Korea Zinc.

DDOG up 5% this week after B of A Securities raised its price target on the stock to $150.

APP down 14% this week on no specific news, however, the company has been under pressure since it failed to be added to the S&P index recently.

CZR up 6% this week on no known company specific news.

BASE up 29% this week after the company announced it entered into a definitive agreement to be acquired by Haveli Investments.

GOOGL down 4% this week on headlines suggesting that AAPL may be looking to integrate other AI search options into Safari.

Earnings Reactions

Earnings reports brought volatility to many individual stocks, with forward guidance being a significant driver of earnings reactions.

Up on Earnings

APPS up 17% this week after reporting better-than-expected financial results and the company received a price target increase.

JBL up 16% this week after reporting financial results and announcing a $500M investment in US manufacturing for cloud and AI data center infrastructure.

KR up 9% this week after the company reported better-than-expected Q1 financial results.

KMX up 4% this week after the company reported financial results and showcased an increase in Q1 retail unit sales, comparable store used unit sales, and wholesale unit sales.

Down on Earnings

ACN down 9% this week after the company reported financial results and announced an AI-focused growth model overhaul effective September 1, 2025.

Market & Economic News

Trump stated that he would not sign a G7 statement on Israel-Iran, according to CBS. He also stated that “everyone should evacuate Tehran immediately”.

The EU stated that reports of its willingness to accept 10% US tariffs were speculative.

Oil prices rose 5% as conflict headlines in the Middle East intensified as the US weighed potential involvement.

The FDA is said to launch a priority voucher program to speed up drug approvals.

The Fed held interest rates steady on Wednesday, citing uncertainty in economic conditions and a steady labor market.

The stock market was closed on Thursday, June 19th, for the Juneteenth Holiday.

The WSJ reported that the US is preparing to take action targeting allies’ chip plants in China.

Uncertainty in the Middle East continued to cause volatility in oil.

Upcoming Earnings

Monday 6/23/25

CMC, FDS, KBH

Tuesday 6/24/25

CCL, FDX, SNX, BB, WOR, AVAV, ATEX

Wednesday 6/25/25

GIS, MU, PAYX, JEF, DAKT, WS, WGO, FUL, NG, SCS, MLKN

Thursday 6/26/25

AYI, NKE, WBA, CNXC, LNN, AOUT, EPAC, MKC, HIVE, OESX

Friday 6/27/25

APOG

Upcoming Economic Events & Data

Monday 6/23/25

S&P Global Composite PMI

S&P Global Manufacturing PMI

Existing Home Sales

Fed Speakers

Tuesday 6/24/25

House Price Index

Fed Chair Powell Testimony

Richmond Manufacturing Index

2-Year Note Auction

Wednesday 6/25/25

MBA Purchase Index

Fed Chair Powell Testimony

New Home Sales

5-Year Note Auction

Thursday 6/26/25

Durable Goods Orders

GDP Growth Rate

Initial Jobless Claims

Continuing Jobless Claims

PCE Prices QoQ Final

Pending Home Sales

7-Year Note Auction

Friday 6/27/25

Fed Speaker

Core PCE Price Index

Personal Income

Personal Spending

Michigan Consumer Sentiment