Weekly Breakdown for the Week of July 14-18, 2025

Rumors of Fed Chair Powell’s Removal Circulate

President Donald Trump has given mixed signals about firing Federal Reserve Chair Jerome Powell, saying he is not planning to act but also not ruling it out.

Trump raised concerns over a $2.7 billion renovation project at the Fed, suggesting possible fraud due to cost overruns, although the project was approved before Powell’s term, and costs rose because of design changes and unexpected conditions.

Legal experts argue that these concerns do not meet the legal threshold of “cause” required to remove the Fed chair, which includes inefficiency, neglect of duty, or malfeasance. Trump has repeatedly criticized Powell for not lowering interest rates and has previously discussed the possibility of firing him.

Although Trump showed lawmakers a draft letter of dismissal, he later denied writing it.

The courts would likely view the renovation issue as a pretext, but because the legal framework surrounding the Fed’s independence is complex and rarely tested, the outcome of any attempt to remove Powell remains uncertain.

Nvidia Prepares for China Chip Sales to Resume

Nvidia (NVDA) CEO Jensen Huang announced that the company will increase the supply of its China-compliant H20 AI chips in the coming months and aims to introduce more advanced semiconductors to the Chinese market, depending on U.S. export approvals.

The move follows the lifting of a U.S. export ban on the H20 chip, which Huang praised for its performance with large language models.

Nvidia is also developing a new chip, the RTX Pro GPU, tailored for China’s growing smart factory and robotics sectors. Huang emphasized China’s leadership in AI and robotics, calling Chinese AI models “world class” and highlighting AI’s impact on global supply chains.

This strategic push comes as Nvidia balances business interests between the U.S. and China amid ongoing tech tensions.

Sarepta Shares Crash on FDA Request to Halt Shipments

Shares of Sarepta Therapeutics (SRPT) plunged over 35% after reports emerged that the FDA may ask the company to halt shipments of its gene therapy Elevidys, following investigations into two patient deaths linked to the treatment and a third involving another Sarepta gene therapy.

Elevidys, which treats Duchenne muscular dystrophy and accounts for over half of Sarepta’s revenue, has faced controversy due to limited evidence of its benefits and failed to meet the primary goal in a Phase 3 trial.

Despite this, the FDA granted expanded approval, a decision some experts saw as premature.

The drug’s delivery method has raised safety concerns, especially after liver failure deaths, and the FDA is now considering whether to remove Elevidys from the market entirely. Investors fear that without Elevidys, which Sarepta relies heavily on, the company could collapse.

Meanwhile, some families urge continued access to the drug, citing personal benefits and the urgent need for treatment options despite the risks.

QuantumScape Surges on Battery Tech Excitement

QuantumScape (QS) shares have surged to a new 52-week high, climbing over 300% from their April lows as excitement grows around next-generation EV battery technology and the company’s upcoming earnings report.

Investors are optimistic following the integration of its Cobra separator process, which significantly boosts manufacturing efficiency and moves the company closer to commercial-scale production of its solid-state lithium-metal batteries.

While earnings expectations still indicate a loss, projected improvements from last year’s results are viewed as a positive sign.

However, analysts warn that the stock’s valuation is overstretched for a pre-revenue company, with a high price-to-book ratio and a consensus price target suggesting potential downside of around 65%.

Netflix Earnings Receive Mixed Reaction

Netflix (NFLX) beat earnings expectations in Q2 2025 with revenue rising 16% year over year to $11.08 billion, driven by subscriber growth, higher pricing, and increased ad revenue.

Net income jumped to $3.1 billion, or $7.19 per share, and the company raised its full-year revenue forecast to as high as $45.2 billion, citing favorable currency exchange and strong member trends.

Operating cash flow and free cash flow surged over 80% and 90% respectively, and Netflix boosted its free cash flow outlook to up to $8.5 billion.

Despite a strong 34.1% operating margin in Q2, the company warned that margins will decline in the second half due to increased content and marketing costs tied to a heavy release slate, including “Stranger Things” and “Wednesday,” which caused shares to dip 5% on Friday.

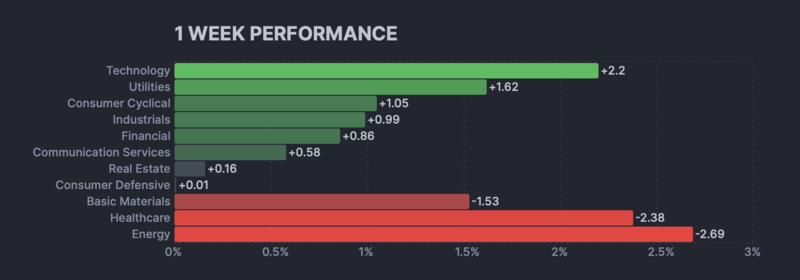

Sector Weekly Performance

Current Themes & Volatile Movers

Headline Reactions

News catalysts of all types caused sharp reactions in many stocks this week.

INKT down 48% this week, retracing most of its recent gains from a publication of complete remission following allogeneic iNKT cell therapy in metastatic testicular cancer. Also, William Blair downgraded the stock to Market Perform.

OKLO up 25% this week after Bloomberg reported that Trump is slated to unveil $70B in AI and energy infrastructure investments.

PLTR up 6% this week on continued momentum in the AI and defense sectors.

EQT up 3% this week as natural gas prices rose by 4% on Monday.

MSTR down 6% this week as bitcoin retraced some of its recent gains on Friday.

CRCL up 18% this week as crypto-related stocks trended higher on the GENIUS Act being signed into law.

HIMS up 4% this week on a relief rally after recent volatility. Also, the company announced it would report earnings on August 4, 2025.

SBET up 17% this week amid crypto sector strength following the company’s recent ETH purchases.

MP up 32% this week after AAPL announced a $500M commitment with the company to produce recycled rare earth magnets in the US.

SMCI up 5% this week as strong momentum in the AI sector persisted following Nvidia’s H20 sales resumption to China.

AMD up 9% this week after CNBC reported the company will resume MI308 chip exports to China.

FSLR up 7% this week after Jefferies raised its price target to $194.

BIDU up 2% this week as Chinese stocks broadly traded higher following the easing of US chip export curbs to China.

NEM down 4% this week following the announcement of the resignation of the company’s CFO.

RGTI up 38% this week after the company unveiled the industry’s largest multi-chip quantum computer.

UMAC up 9% this week following reports that the Pentagon aims to increase low-cost drone production in the US.

JOBY up 50% this week after the company announced that it’s expanding its manufacturing capacity in California and Ohio and is adding aircraft to its fleet.

QBTS up 23% this week on continued momentum in the quantum computing sector.

BBAI up 29% this week as strength in the AI sector persisted. The company also announced it will report Q2 earnings results on August 11.

ACHR up 30% this week as recent government initiatives to develop the drone industry propelled the sector higher.

LLY down 3% this week following recent news that Zepbound faces a potential weight-loss rival made by a Chinese biotech firm.

CRWV down 6% this week after HSBC stated that the company could face a share price drop of 70% on concerns around its customer base.

HOOD up 9% this week after Trump signed the GENIUS Act stablecoin bill into law.

ETHA up 16% this week as ETH neared $3,600 on Friday.

DELL up 4% this week after B of A Securities raised its price target on the stock to $165.

Earnings Reactions

Earnings reports brought volatility to many individual stocks this week, with forward guidance being a significant driver of earnings reactions.

Up on Earnings

JNJ up 4% this week after the company reported financial results and increased its FY25 adjusted EPS guidance.

UAL up 6% this week following the release of the company’s financial report and guidance at the mid-point of estimates.

TSM up 5% this week after reporting better-than-expected financial results, and the company received several price target increases.

Down on Earnings

WFC down 2% this week after reporting financial results and stating that net interest income will be roughly in line with 2024 levels.

ASML down 7% this week after the company reported financial results and announced it could not confirm 2026 growth at this stage.

ABT down 6% this week after the company reported financial results and issued lower-than-expected EPS guidance.

ELV down 17% this week after reporting financial results and receiving several price target cuts.

Market & Economic News

Trump is reported to be preparing $70B in AI and energy investments.

White House advisor Hassett is said to be in the running for the Fed Chair position in the future.

US CPI data was slightly higher than expected on an annualized basis at 2.7% vs 2.6% consensus.

Bond yields rose following the CPI report, with the 30-year yield breaking above 5%.

Reports circulated regarding Trump being open to removing Fed Chair Powell, although the President later stated that while he wouldn’t rule out the idea, it would be “highly unlikely” and would require fraud to be found as grounds.

The White House is said to open up retirement accounts to crypto investments.

The US is to impose a 93.5% duty on graphite imports from China.

Tariff demands in EU trade talks were said to be a 15-20% minimum, according to the Financial Times.

The EU will lower its price cap on Russian oil in a new sanctions package.

Upcoming Earnings

Monday 7/21/25

VZ, NXPI, DPZ, STLD, CLF, AGNC, ROP, CALX, DX, CCK

Tuesday 7/22/25

LMT, ISRG, KO, SAP, ENPH, PM, DHI, MTDR, GM, COF, RTX, TXN, DHR, RRC, KEY, NOC

Wednesday 7/23/25

GEV, TSLA, FCX, GOOGL, NOW, APH, IBM, T, TMO, CMG, FI, CMG, NEE

Thursday 7/24/25

AAL, INTC, BX, NEM, DECK, NOK, DOC, LUV, SCHL, NDAQ, UNP, HON, BYD, COUR

Friday 7/25/25

CNC, HCA, AN, CHTR, BAH, TNET, EAF, GNTX, SBSI, SAIA

Upcoming Economic Events & Data

Monday 7/21/25

CB Leading Index

Tuesday 7/22/25

Fed Chair Powell Speech

Redbook YoY

Richmond Fed Manufacturing Index

Money Supply

Wednesday 7/23/25

30-Year Mortgage Rate

Existing Home Sales

20-Year Bond Auction

Thursday 7/24/25

Chicago Fed National Activity Index

Initial Jobless Claims

Continuing Jobless Claims

10-Year TIPS Auction

Friday 7/25/25

Durable Goods Orders MoM

Non Defense Goods Orders

Baker Hughes Oil Rig Count