Powell Signals Openness to Rate Cuts

Federal Reserve Chair Jerome Powell delivered a closely watched speech at Jackson Hole on Friday, signaling cautious openness to future rate cuts while stressing the uncertainty facing policymakers.

He highlighted shifting risks due to changes in tax, trade, and immigration policies, noting that while the labor market and economy remain resilient, tariffs pose potential inflation risks that could lead to stagflation.

Powell said the current restrictive policy gives the Fed room to proceed carefully, though the balance of risks may eventually justify a policy adjustment.

His remarks were enough to boost stocks and lower Treasury yields as markets interpreted them as a step toward cuts at the upcoming September meeting.

He also reflected on lessons learned from the Fed’s 2020 policy framework review, acknowledging mistakes in handling inflation while reaffirming the central bank’s 2% inflation target.

Opendoor Technologies Gains Social Momentum

Opendoor Technologies (OPEN) has seen its stock surge amid a wave of investor enthusiasm following the company’s renewed focus on artificial intelligence.

Interim CEO, Shrisha Radhakrishna, described AI as a key driver for future growth across pricing, marketing, and home assessments.

Supporters, including hedge-fund manager Paul Tudor Jones and investor Anthony Pompliano, argue that the stock’s rise reflects retail investors acting collectively to influence company strategy rather than a meme-stock phenomenon.

However, skeptics caution that AI’s role in real estate may be limited, noting that it cannot fully replace physical inspections or address Opendoor’s high-risk, capital-intensive business model.

While shares are up more than 200% year-to-date after a 500% spike in July, concerns remain about the company’s weak financial outlook, earnings miss, and sustainability of the rally.

Alphabet Spikes on Gemini AI Interest

Alphabet (GOOGL) shares gained after reports that Apple (AAPL) is in renewed talks to license Google’s Gemini AI model to power a revamped version of Siri, which could debut with the iPhone 17 next year.

A deal would strengthen Google’s position in generative AI by embedding Gemini directly into Apple’s massive iPhone ecosystem, creating a high-profile showcase against rivals like OpenAI’s ChatGPT.

The potential licensing agreement, highlighted by CEO Sundar Pichai in prior testimony, underscores Google’s push to monetize Gemini and deepen ties with Apple despite antitrust scrutiny.

Adding to the momentum, Meta (META) signed a six-year deal to use Google Cloud for AI workloads, further boosting sentiment around Google’s AI business.

Viking Therapeutics Falls on Disappointing Data

Viking Therapeutics (VKTX) shares plunged 41% after its experimental weight-loss pill VK2735 delivered a 12.2% average body weight reduction in a mid-stage trial, falling short of Wall Street’s high-end expectations of 15%.

The study, involving 280 overweight and obese adults, also showed a high dropout rate, with 20% of participants discontinuing due to gastrointestinal side effects like nausea and vomiting.

While Viking plans to adjust dosing schedules in future trials to improve tolerability, the results highlight the challenges oral weight-loss drugs face in competing with injectable treatments from Novo Nordisk (NVO) and Eli Lilly (LLY), which have shown greater efficacy.

Despite prior investor optimism, analysts noted the data underperformed earlier expectations, raising concerns about the drug’s competitiveness in the fast-growing obesity market.

Nvidia Navigates China AI Chips and Earnings Report

Nvidia (NVDA) faces a pivotal week as reports surfaced that the company has asked suppliers to halt production of its China-focused H20 AI chip after government pressure there discouraged local firms from using the product, raising uncertainty around one of its key overseas markets.

The H20 was designed to comply with U.S. export restrictions, and any disruption could weigh on Nvidia’s sales outlook tied to China.

At the same time, investors are preparing for the company’s upcoming quarterly earnings on August 27, where expectations center on strong revenue near $46 billion and continued profit growth.

The focus will be on guidance, demand trends in data centers, the pace of the Blackwell chip ramp, and how geopolitical pressures may influence future results, making this report one of the most closely watched of the season.

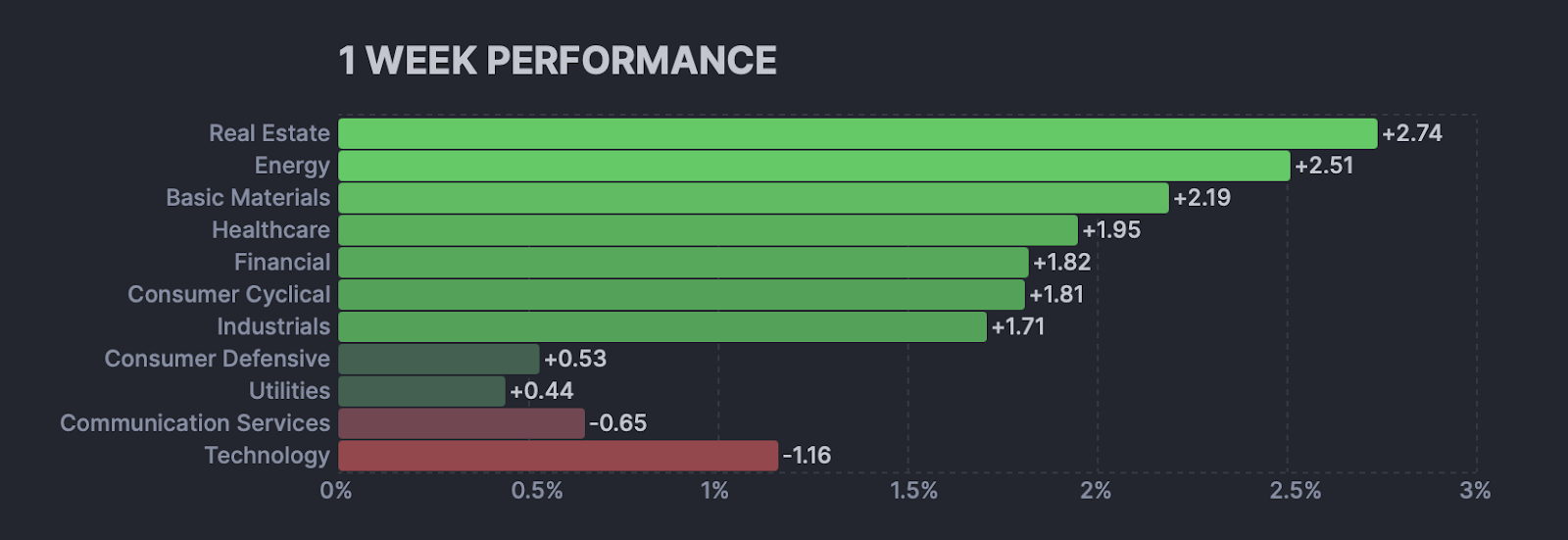

Sector Weekly Performance

Current Themes & Volatile Movers

Headline Reactions

News catalysts of all types caused sharp reactions in many stocks this week.

TNXP down 16% this week following recent FDA approval for its Tonmya product that has been criticized on social media.

CRCL down 8% this week after Circle acquired Malachite to power the new Arc blockchain network.

INTC up 5% this week after the Trump Administration was said to take a 10% stake in the company.

EQT up 4% this week despite a Roth Capital downgrade and price target cut.

META down 2% this week amid reports that the stock faces congressional scrutiny, with some US senators calling for an investigation related to AI.

MU down 4% this week amid broad weakness in the chip sector early in the week.

ETHA up 10% this week as crypto prices broadly bounced, with ETH crossing $4,800.

RDDT down 12% this week amid a broad unwind in bullish positioning over the past several sessions.

DELL down 5% this week amid broad technology sector weakness.

XPEV up 18% this week after co-founder Xiaopeng He purchased shares of the company in the open market.

NMAX up 21% this week after Noble Capital Markets announced a $23 price target.

PSKY up 17% this week on investor optimism after its recent merger and media deals.

PDD up 6% this week in anticipation of upcoming financial results on August 25.

FSLR down 5% this week after Trump stated the US would not approve certain solar and wind power projects.

HPE up 5% this week after Morgan Stanley upgraded the stock to “Overweight”.

UUUU up 9% this week after the company announced it produced its first high-purity dysprosium oxide in the US and plans commercial scaling in 2026.

SOFI up 5% this week after several investment banks raised price targets on the stock.

PLTR down 10% this week as momentum slowed following a bearish note from Citron Research.

ORCL down 4% this week amid broad tech weakness and the departure of its longtime Security Chief.

WULF down 9% this week after the company announced an upsizing and pricing of its $850M convertible notes offering.

NIO up 29% this week after the third-generation ES8 vehicles went on display in China showrooms.

W down in after-hours trading on Friday after Trump made comments related to furniture tariffs.

TEM up 13% this week after the company acquired Paige for $81M.

Earnings Reactions

Earnings reports brought volatility to many individual stocks, with forward guidance being a significant driver of earnings reactions.

Up on Earnings

PANW up 5% this week after reporting financial results and strong guidance.

ADI up 8% this week after reporting better-than-expected sales results.

Down on Earnings

JHX down 30% this week after reporting financial results and receiving several price target cuts.

TGT down 5% this week after reporting financial results and receiving several price target cuts.

WMT down 4% this week after reporting earnings and saying AI is not yet boosting sales.

Market & Economic News

Conflict resolution negotiations are currently taking place between Russia and Ukraine.

ETH fell to roughly $4K earlier in the week as recent momentum slowed before rebounding to $4.8K on Friday.

Trump called for Fed Governor Cook’s resignation over a mortgage probe.

Fed meeting minutes showed concern over both inflation risks and labor market risks, with new economic reports likely to put labor data into the spotlight.

US existing home sales surged in Thursday’s data, beating forecasts and previous data.

Fed Chair Powell had a dovish tone in his Jackson Hole speech on Friday, causing September rate cut odds to surge and short duration bond yields to fall sharply.

Trump stated there will be a major tariff investigation on imported furniture.

Upcoming Earnings

Monday 8/25/25

PDD, SMTC, HEI, NSSC, MOLN, SSL

Tuesday 8/26/25

BMO, OKTA, BNS, MDB, BEKE, BOX, ATAT, NCNO, EH, OOMA

Wednesday 8/27/25

KSS, NVDA, ANF, SNOW, CRWD, HPQ, WSM, RY, URBN, FIVE

Thursday 8/28/25

DG, MRVL, DELL, BBY, TD, IREN, CM, ULTA, S, GAP, DKS, LI, WOOF, AFRM

Friday 8/29/25

BABA, DOOO, FRO

Upcoming Economic Events & Data

Monday 8/25/25

Chicago National Fed Activity

New Home Sales

Dallas Fed Manufacturing Index

Tuesday 8/26/25

Durable Goods Orders MoM

Redbook

House Price Index

Richmond Fed Manufacturing Index

Dallas Fed Services Index

2-Year Note Auction

Wednesday 8/27/25

MBA Purchase Index

EIA Crude Oil Stocks Change

5-Year Note Auction

Thursday 8/28/25

GDP Growth Rate QoQ

Initial Jobless Claims

Continuing Jobless Claims

PCE Prices QoQ

Pending Home Sales

7-Year Note Auction

Friday 8/29/25

Core PCE Price Index

PCE Index

Personal Income

Personal Spending

Chicago PMI

Michigan 5-Year Inflation Expectations