Weekly Breakdown for the Week of June 30 – July 4, 2025

BitMine Adopts Crypto Treasury Strategy

Tom Lee, a prominent market strategist known for his bitcoin predictions, has been appointed chairman of BitMine Immersion Technologies (BMNR), a little-known bitcoin mining firm aiming to become the largest publicly traded holder of Ether.

The company announced a $250 million private placement to fund an Ether accumulation strategy, making Ether its primary treasury asset while continuing its Bitcoin mining operations.

Lee highlighted the growing convergence of finance and crypto, driven by the viral adoption of stablecoins built on the Ethereum network.

BitMine will measure its performance by Ether held per share, similar to how MicroStrategy (MSTR) tracks Bitcoin per share.

This move aligns with a broader trend of companies diversifying their crypto treasury strategies beyond Bitcoin, with others also focusing on Ether and Solana.

BitMine, which previously had a modest $26 million market cap and declining stock, is now up nearly 3,000% on the week and has a market capitalization of roughly $800 million.

Spending Bill Passes Congress

Markets rallied after the newly passed “One Big Beautiful Bill Act” introduced sweeping tax cuts and spending changes that will impact the financial landscape. SPY was up 2% on the week and is trading at all-time highs.

The bill elicited mixed, but mostly positive, reactions across multiple sectors, including financials, technology, healthcare, cryptocurrency, autos, and industrials.

The bill extends the 2017 tax cuts indefinitely, with new deductions for tips, overtime, car loan interest, and a boosted child tax credit.

Tipped workers, overtime earners, car buyers of US-made vehicles, homeowners in high-tax states, and seniors receive targeted tax breaks, though most are temporary.

However, the bill also tightens eligibility for Medicaid and food assistance programs, ends enhanced tax credits under the Affordable Care Act, and shifts costs to states, potentially causing some to lose health coverage over the next decade.

While proponents tout the bill as a win for working families and economic growth, critics argue it delivers large benefits to the wealthy and threatens healthcare access for many.

Datadog Surges on S&P Inclusion Announcement

Datadog (DDOG) shares jumped 18% this week following news that it will replace Juniper Networks (JNPR) in the S&P 500 index, effective July 9.

The change comes after Hewlett Packard Enterprise (HPE) completed its $13.4 billion acquisition of Juniper and agreed to divest certain assets as part of a settlement with the U.S. Justice Department.

Datadog, a cloud monitoring software company that went public in 2019, joins a growing list of tech firms added to the index as the sector’s influence continues to expand.

Despite underperforming the broader tech market in 2025 so far, Datadog has a robust valuation with a $46 billion market cap and posted $24.6 million in Q1 net income on $761.6 million in revenue.

Its inclusion in the S&P 500 could boost demand for its stock as index-tracking funds adjust their portfolios.

Tariff Pause Set to Expire on July 9th

A temporary pause on broad U.S. tariffs is set to expire on July 9, potentially raising costs for businesses and consumers if no extension is granted.

While President Trump initially paused the tariffs to allow time for trade negotiations, he has recently indicated that the pause may not be extended and that countries are being notified of new tariff rates.

A trade agreement was reached with Vietnam, introducing U.S. tariffs on Vietnamese imports while removing tariffs on American goods entering Vietnam.

Discussions with key partners, including the European Union, Japan, and India, are ongoing, but no comprehensive deals have been finalized. If the pause expires, tariffs could be reinstated on a wide range of imports, including steel, autos, and agricultural products.

Analysts note that renewed tariffs may contribute to market volatility and higher prices, particularly as businesses deplete existing inventories stocked ahead of previous tariff deadlines.

The situation remains fluid, with ongoing negotiations and uncertainty surrounding the broader economic impact.

Robinhood Expands Crypto Offerings

Robinhood (HOOD) is expanding its cryptocurrency-related services as part of a broader effort to develop into a global digital asset platform.

European users can access tokenized equities, along with tokens representing private companies such as OpenAI and SpaceX. However, these private companies have stated that the tokens do not represent actual ownership and are unaffiliated derivatives.

Robinhood is also developing its own blockchain and plans to introduce leveraged Bitcoin and Ether futures in Europe later this summer. In the U.S., new offerings include crypto staking for Ethereum and Solana, rewards linked to its credit card, tax-lot selection tools, and an AI-based investing assistant.

These initiatives follow Robinhood’s acquisitions of Bitstamp and WonderFi and align with CEO Vlad Tenev’s stated goal of expanding the firm’s role in the digital finance space while navigating ongoing regulatory scrutiny.

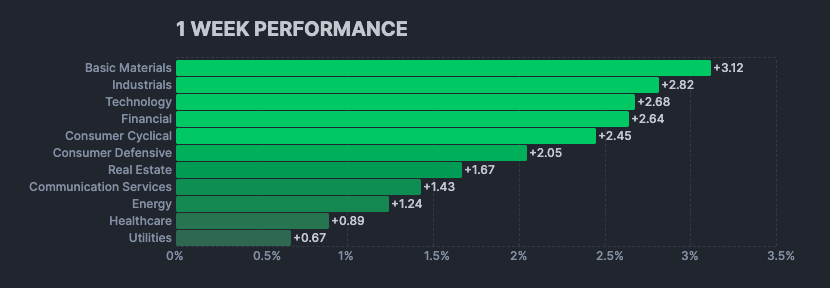

Sector Weekly Performance

Current Themes & Volatile Movers

Headline Reactions

News catalysts of all types caused sharp reactions in many stocks this week.

BBAI up 35% this week on continued momentum in small-cap AI-related stocks.

JOBY up 12% this week after the company announced it completed a series of test flights in Dubai.

HPE up 15% this week after the company and Juniper Networks reached an agreement with the US DOJ to resolve its lawsuit challenging HPEs acquisition of Juniper, clearing the way for the deal to close.

AAPL up 5% this week following a report indicating the company is weighing using Anthropic or OpenAI to power Siri.

FSLR up 17% this week as an amendment to ease solar and wind tax credit phaseouts was added to the spending bill.

JNPR up 8% this week as its deal with HPE is closer to happening after reaching an agreement with the DOJ.

MSTR up 4% this week as the company added another 4,980 BTC to its treasury this past week.

TSLA down 2% this week amid public disagreements between Musk and Trump on federal spending issues. However, the release of its Q2 production numbers of 410,244 vehicles and total deliveries of 384,122 vehicles exceeded expectations.

F up 10% this week after the company reported its June total vehicle sales numbers.

SNAP up 8% this week after Trump stated that a buyer group for TikTok has been found and a nod from China is now needed.

NVDA up 2% this week despite reports that Chinese AI rivals look to cash in on the US tech ban.

LVS up 10% this week as casino stocks were broadly strong on Tuesday.

PLTR down 4% this week as recent volatility accelerated in the stock amid the spending bill’s impact on the defense sector.

CNC down 37% this week after the company withdrew its previous 2025 GAAP adjusted diluted EPS guidance, including the underlying guidance.

CIFR up 45% this week after the company announced updates on the self-mining hashrate capacity for Phase 1 of its Black Pearl data center.

CRCL down 12% this week after Ripple announced that it applied for a US banking license.

MARA up 16% this week amid rising crypto prices.

RGTI up 20% this week after Cantor Fitzgerald initiated coverage with a Buy rating and assigned a price target of $15.

ORCL up 11% this week following a report suggesting that OpenAI is renting computing power from the company’s data centers as part of its Stargate initiative.

OSCR down 19% this week after Barclays initiated coverage on the stock with an Underweight rating and a $17 price target.

OLO up 15% this week after the company announced it entered into a definitive agreement to be acquired by Thoma Bravo at a valuation of $2B.

IREN up 25% this week after the company announced it purchased 2.4K next-gen Nvidia Blackwell B200 and B300 PGUs for $130M.

RGC up 18% this week amid an apparent short-squeeze.

CRWV up 3% this week after it was reported that the company became the first hyperscaler to deploy Nvidia’s GB300 NVL72 platform.

Market & Economic News

Canada’s Carney affirmed that US-Canada talks restarted after the digital tax withdrawal.

Trump is said to be meeting with his trade team to set specific country-by-country tariff rates this week.

Trump stated that he is not considering an extension of the July 9th deadline for trade deals to be made with the US.

The spending bill officially passed Congress on Thursday.

A trade agreement between the US and Vietnam was reached on Wednesday.

The stock market closed early on Thursday, July 3rd at 1 PM due to the Independence Day Holiday.

The stock market was closed Friday, July 4th for the Independence Day Holiday.

Fed rate cut expectations shifted to September after strong jobs data was reported on Thursday.

Upcoming Earnings

Monday 7/7/25

N/A

Tuesday 7/8/25

PENG, KRUS, SAR, AEHR

Wednesday 7/9/25

AZZ, BSET

Thursday 7/10/25

DAL, LEVI, CAG, WDFC, BYNR, PSMT, SMPL, ETWO, HELE, VIST, NTIC

Friday 7/11/25

N/A

Upcoming Economic Events & Data

Monday 7/7/25

Fed Balance Sheet

Tuesday 7/8/25

Redbook YoY

Consumer Inflation Expectations

3-Year Note Auction

Consumer Credit Change

Wednesday 7/9/25

Wholesale Inventories MoM

EIA Crude Oil Stocks Change

10-Year Note Auction

FOMC Minutes

Thursday 7/10/25

Initial Jobless Claims

Continuing Jobless Claims

30-Year Bond Auction

Friday 7/11/25

WASDE Report

Baker Hughes Oil Rig Count