Weekly Breakdown for the Week of August 11-15 2025

TeraWulf Lands Two Computing Hosting Agreements

TeraWulf (WULF) shares surged after announcing two 10-year high-performance computing hosting agreements with AI cloud platform Fluidstack, valued at about $3.7 billion, with potential to reach $8.7 billion through extensions.

Google (GOOGL) will backstop $1.8 billion of Fluidstack’s lease obligations in exchange for roughly 41 million TeraWulf shares, giving it an 8% stake.

The projects will add over 200 MW of capacity at TeraWulf’s Lake Mariner data center, with initial operations starting in early 2026.

Analysts from Rosenblatt, Keefe Bruyette, and Citizens JMP called the deals transformative, raised price targets significantly, and cited improved risk profile, lower cost of capital, and strong growth prospects following the company’s Q2 beat and pivot toward hyperscale AI infrastructure.

Berkshire Hathaway’s 13F Filing Reveals Recent Activity

Berkshire Hathaway’s latest 13F filing showed a $1.6 billion position in UnitedHealth Group (UNH), likely accumulated quietly since late last year, alongside new stakes in Allegion (ALLE), D.R. Horton (DHI), Lamar Advertising (LAMR), and Nucor (NU).

The firm fully exited T-Mobile (TMUS), sold nearly half its Charter Communications (CHTR) stake, and trimmed positions in Apple (AAPL) and Bank of America (BAC) while adding to Chevron (CVX).

Overall, Berkshire is rotating capital into defensive growth and stable cash flow sectors such as healthcare, housing, and consumer staples. At the same time, Berkshire is reducing exposure to overconcentrated tech and banking positions, exiting certain telecom holdings, and selectively reinforcing energy bets.

Bullish Makes IPO Debut

Bullish (BLSH), a cryptocurrency exchange led by former NYSE President Tom Farley and backed by Peter Thiel, surged in its NYSE debut after raising about $1.1 billion in an IPO priced at $37 per share, far above expectations.

Shares opened at $90, briefly hit $118, and closed at $69 for the week, valuing the company at about $10 billion.

Targeting institutional investors, Bullish blends decentralized finance protocols with centralized security and has handled over $1.25 trillion in trading volume since its 2021 launch.

The IPO reflects growing institutional interest in crypto and comes amid a wave of U.S. listings in the sector under the crypto-friendly Trump administration.

Intel Spikes on Possible Government Backing

The Trump administration is considering taking a stake in Intel (INTC) to bolster U.S. chip manufacturing and reduce reliance on foreign suppliers such as Samsung and TSMC (TSM), framing the move as a matter of national security.

The potential intervention, which could use funds from the CHIPS Act, follows billions in government support already awarded to Intel and comes as President Trump pushes for more high-end technology production within the country.

Intel’s shares rose on the news, which underscores growing concerns over maintaining domestic control of critical technologies like semiconductors and AI infrastructure.

PPI Inflation Data Comes in Hot

U.S. wholesale prices surged 0.9% in July, far exceeding expectations and marking the biggest monthly gain since June 2022, raising concerns that inflationary pressures remain strong.

The producer price index rose 3.3% year-over-year, driven largely by a sharp increase in services costs, particularly machinery and equipment wholesaling, portfolio management fees, and airline fares.

The jump, which comes amid ongoing tariff impacts, tempered market expectations for multiple Federal Reserve rate cuts this year, though a September cut is still seen as likely.

The report also highlights that businesses may soon start passing higher costs to consumers, while it arrives amid heightened scrutiny over BLS data accuracy following leadership changes and budget-driven reporting cutbacks.

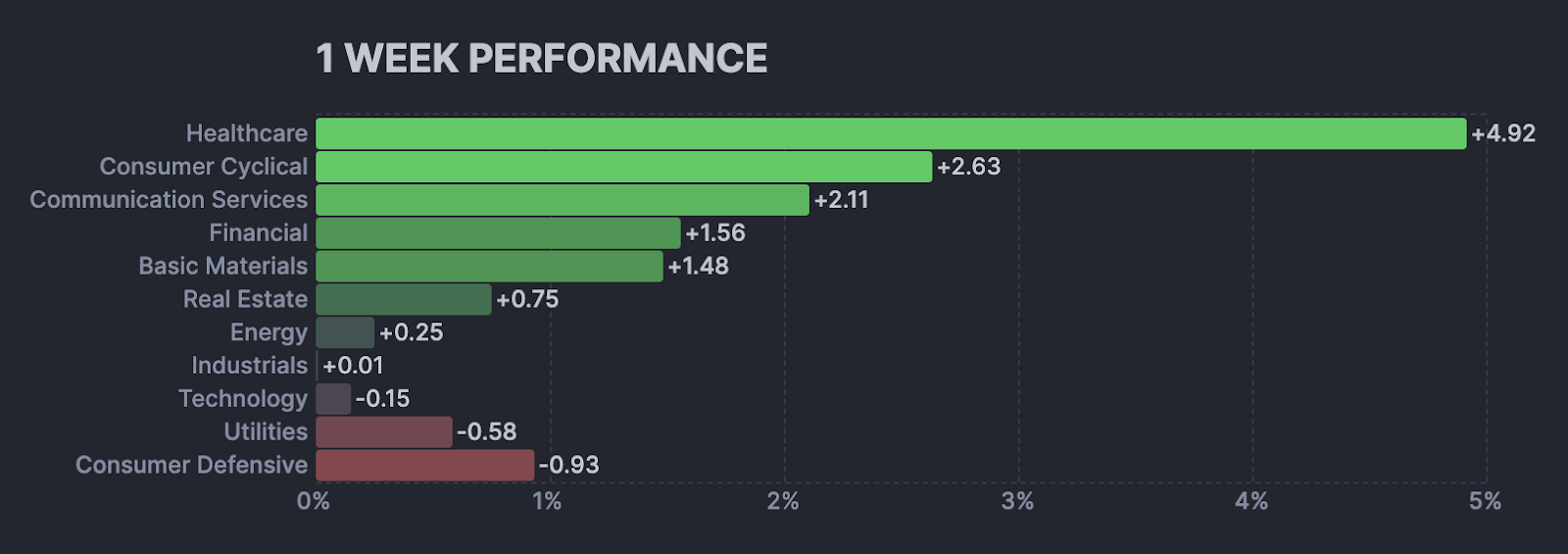

Sector Weekly Performance

Current Themes & Volatile Movers

Headline Reactions

News catalysts of all types caused sharp reactions in many stocks this week.

TPR down 7% this week after the company reported financial results.

CRCL down 4% this week after the company recently announced a public offering of 10M shares.

PSKY up 31% this week after the company recently announced a seven-year media rights agreement making it the exclusive US home for UFC events.

AMD up 4% this week on the US-China trade extension, and optimism for second-half chip sales.

AAPL up 2% this week after Bloomberg announced the company is expanding into AI robotics, home security, and smart displays.

ATNF up 133% this week on recent news of the company’s ETH treasury strategy.

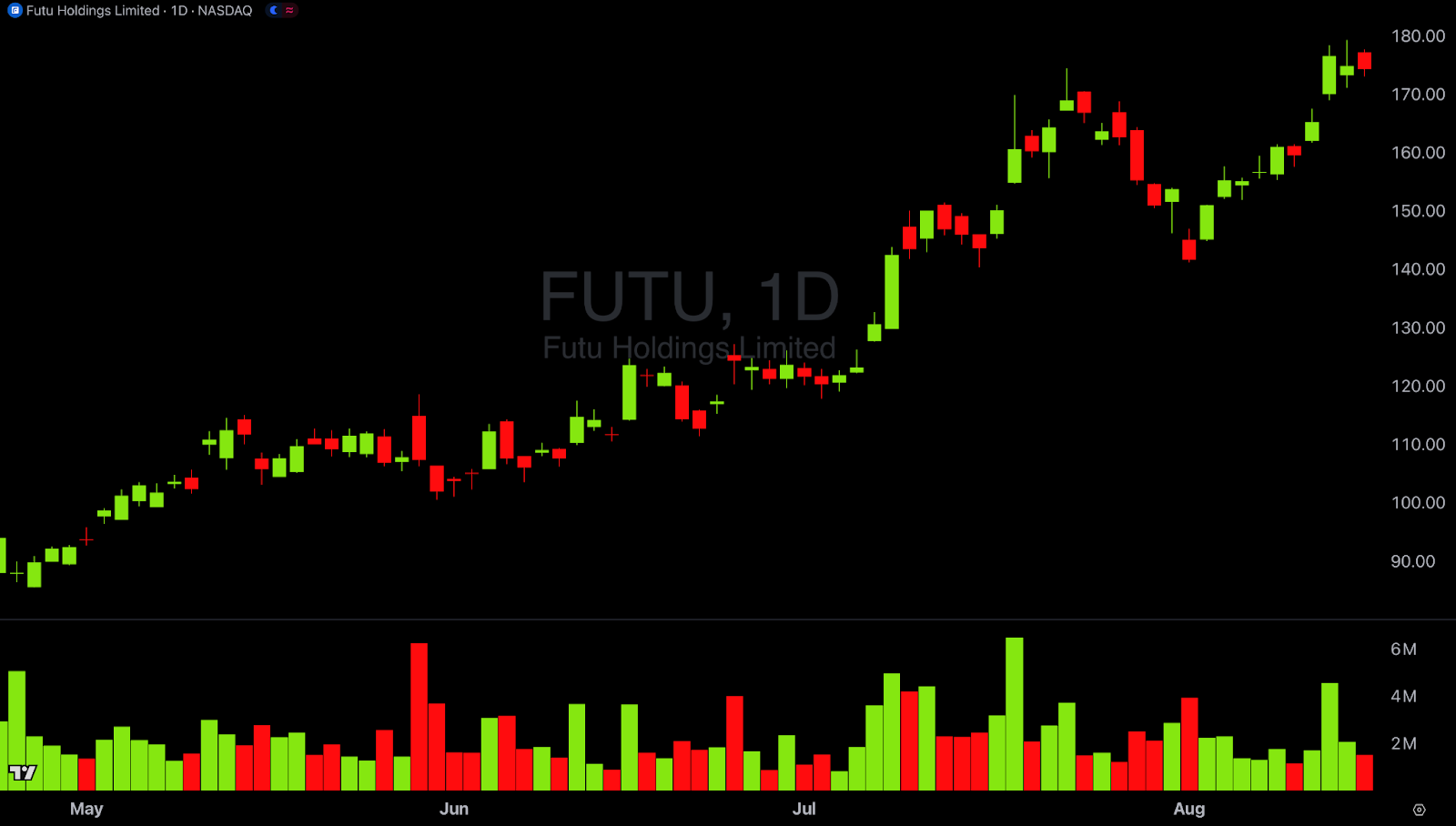

FUTU up 9% this week as broad strength in Chinese equities persisted after the extension of a US-China trade agreement.

UAL up 12% this week after July’s inflation report showed a rise in ticket prices and a decline in gasoline costs.

META up 2% this week after the company announced it has 400M active monthly users on its Threads platform.

SOUN up 7% this week after Ladenburg Thaimann upgraded the stock to a buy and released a $16 price target.

RUN up 13% this week after the Treasury Department posted new guidance on energy tax credits.

LRCX down 3% this week after AMAT issued weak forward guidance, and Trump stated that he would be setting tariffs on chips next week.

SPOT up 5% this week as recent momentum in the stock continued.

Earnings Reactions

Earnings reports brought volatility to many individual stocks, with forward guidance being a significant driver of earnings reactions.

Up on Earnings

RGTI up 9% this week on continued momentum following its earnings release and a price target hike by Benchmark.

SE up 19% this week after the company reported better-than-expected Q2 sales results.

AI up 19% this week after the company reported preliminary revenue guidance results. Also, the company got a price target cut and a downgrade from a financial firm.

ASTS up 4% this week after the company released earnings results and stated it is preparing to deploy nationwide intermittent service in the US by the end of 2025.

NU up 7% this week after reporting earnings and Berkshire Hathaway disclosed a stake in the company in its 13F filing.

Down on Earnings

AMCR down 10% this week after the company reported an earnings miss.

CRWV down 23% this week after the company recently released financial results and reports of share lockup periods ending this week circulated.

CAVA down 18% this week after the company reported earnings and received several price target cuts.

BBAI down 9% this week after the company reported worse-than-expected financial results.

OKLO down 2% this week following the release of the company’s quarterly financials and the announcement that Oklo and Lightbridge are to evaluate additional co-location opportunities for manufacturing.

RCAT down 11% this week after the company reported worse-than-expected earnings and a short-report was issued against the company.

SBET down 17% this week after the company reported financial results and ETH dipped below recent highs on Friday.

AMAT down 13% this week after the company issued weak forward guidance and several firms cut their price target on the stock.

Market & Economic News

Trump extended China tariff relief for an additional 90 days.

The White House stated that gold will not be tariffed.

Traders fully priced in a quarter point Fed rate cut in September according to Bloomberg.

US consumer price data came in mostly in line with expectations on Tuesday at 2.7%.

Crypto prices surged on Wednesday with $BTC crossing $123K and $ETH touching $4.7K.

Trump criticized Powell again for current interest rate levels and brought up the possibility of a lawsuit against Powell related to project overspend.

US producer price data was above expectations on Thursday.

Multiple 13F filings were released on Thursday, revealing what money managers with significant assets bought or sold over the last reporting period.

US retail sales grew 0.5% in July, slightly under estimates.

Trump stated he will be setting tariffs on chips and steel next week.

Upcoming Earnings

Monday 8/18/25

CRGO, PANW, BTDR, BLNK, RSKD, FN, CBAT, API, XP

Tuesday 8/19/25

HD, TOL, AS, ZTO, VIK, JHX, MDT, LZB, XPEV, OPRA, KEYS, FLNT

Wednesday 8/20/25

TGT, NDSN, CAAP, BBAR, COTY, AAPG, TLX, UFI, BIDU, FUTU

Thursday 8/21/25

WMT, ZM, HOV, WDAY, CSIQ, INTU, ROST, OSIS, VENT

Friday 8/22/25

BJ, GFI

Upcoming Economic Events & Data

Monday 8/18/25

NAHB Housing Market Index

Tuesday 8/19/25

Building Permits

Housing Starts

Redbook

API Crude Oil Stock Change

Wednesday 8/20/25

MBA Purchase Index

EIA Crude Oil Stocks Change

20-Year Bond Auction

FOMC Minutes

Thursday 8/21/25

Initial Jobless Claims

Continuing Jobless Claims

Philadelphia Fed Manufacturing Index

Philly Fed Employment

Existing Home Sales

30-Year TIPS Auction

Friday 8/22/25

Baker Hughes Oil Rig Count