Weekly Breakdown for the Week of July 21-25, 2025

Tesla Earnings Disappoint: Musk Talks Path Forward

Tesla (TSLA) reported weaker-than-expected Q2 results, with automotive revenue down 16% year-over-year to $16.7 billion and total revenue of $22.5 billion missing analyst estimates.

Vehicle deliveries fell for the second straight quarter, and regulatory credit sales nearly halved.

Shares dropped after the earnings call, as CEO Elon Musk and CFO Vaibhav Taneja warned of possible rough quarters ahead due to rising tariffs and the end of the federal EV tax credit. Tesla also cited supply chain challenges and political backlash from Musk’s recent actions.

Despite declining profits and growing competition from Chinese EV makers, Tesla emphasized future growth through upcoming affordable models, expanding its Supercharger network, and ongoing development of robotaxis and the Optimus humanoid robot.

However, Tesla’s autonomous driving efforts still trail competitors like Alphabet’s (GOOGL) Waymo.

Alphabet Reports Strong Quarter & Increased Capex

Alphabet (GOOGL) beat Q2 expectations with revenue of $96.43 billion and earnings per share of $2.31, driven by strong performance across Google Search, YouTube, and Google Cloud.

Revenue rose 14% year over year, and net income jumped nearly 20% to $28.2 billion. YouTube and Cloud both outpaced analyst forecasts, with Cloud revenue up 32% to $13.62 billion.

Despite the strong quarter, Alphabet raised its 2025 capital expenditure forecast from $75 billion to $85 billion due to growing demand for AI and cloud services, and stated that it expects even higher spending in 2026.

CEO Sundar Pichai highlighted the expansion of AI adoption, including a partnership with OpenAI and rapid user growth for AI Overviews and the Gemini chatbot.

Operating expenses rose 20%, including a $1.4 billion legal settlement, and the company noted that Q3 revenue could be affected by a decline in U.S. election-related ad spending that boosted last year’s numbers.

UnitedHealth Group Discloses DOJ Investigation

UnitedHealth Group (UNH) has disclosed that it is under investigation by the Department of Justice for its Medicare billing practices, marking another challenge for the healthcare giant, which operates the nation’s largest private insurer.

The company has begun cooperating with the DOJ and initiated a third-party review of its policies, which is expected to conclude by the end of Q3.

This comes after reports that doctors may have been pressured to submit claims that inflated Medicare Advantage payments. Despite previously denying the probes, UnitedHealth now acknowledges them and maintains confidence in its practices.

The company highlighted favorable audit results and a legal recommendation supporting its stance; however, its Medicare segment, which generated $139 billion in revenue in 2023, remains under scrutiny.

Shares dropped following the news, adding to a broader 45% decline this year amid leadership changes, rising medical costs, and recent controversies.

Kohl’s Catches Meme Feaver

Kohl’s (KSS) shares surged nearly 38% earlier this week as retail investors revived interest in meme stocks, fueled by online communities like Reddit’s WallStreetBets.

Despite weak sales and a recent $15 million quarterly loss, the stock rallied alongside names like Opendoor (OPEN) and GoPro (GPRO), driven more by social media hype than fundamentals.

The excitement mirrors past meme-stock trends, where struggling companies see sharp price jumps due to retail speculation and clashes with short sellers.

Experts warn this frenzy could signal broader market froth, with analysts calling the extreme price swings and investor exuberance potential red flags amid otherwise solid corporate earnings.

Kohl’s stock retraced nearly half of the gains over the following few days, signaling that while meme fever may have returned, it may not have the same strength as the original wave.

Oklo Soars on Partnership Announcements

Nuclear startup Oklo announced a new partnership with oil services firm Liberty Energy (LBRT) to develop integrated power solutions for energy-intensive clients like data centers and industrial sites.

Liberty will initially supply natural gas power until Oklo’s zero-carbon nuclear systems are operational, aiming to transition customers to clean baseload energy. This collaboration builds on Liberty’s prior $10 million investment in Oklo.

Shares of both companies rose following the news, with Liberty also benefiting from a separate capacity auction announcement that signaled rising energy demand.

This marks Oklo’s second major partnership within a few days, following a deal with Vertiv (VRT) to develop data center cooling systems powered by Oklo’s on-site nuclear heat.

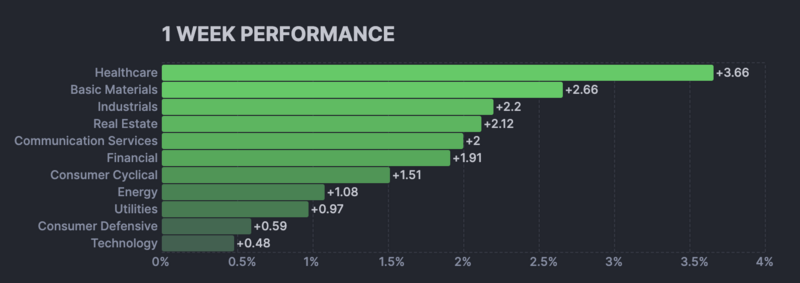

Sector Weekly Performance

Current Themes & Volatile Movers

Headline Reactions

News catalysts of all types caused sharp reactions in many stocks this week.

XYZ up 10% this week after it was announced that the stock will join the S&P 500. The stock received several price target increases after the announcement.

BBAI down 7% this week as momentum slowed in several small-cap AI-related stocks.

SBET down 35% this week on continued selling pressure after announcing a filing to sell up to $5B in stock.

ETHA up 3% this week on continued strength in the price of Ethereum, which was trading near $3,700.

RXRX up 9% this week after the company recently announced a new feature in Wired, highlighting the progress the company is making.

NVTS up 39% this week amid apparent short covering as social media mentions were higher than normal. Additionally, the company stated it will report Q2 financial results on Monday, August 4th.

EQT down 7% this week after Adevinta stated it sold its Spanish business to EQT for $2.3B.

HOOD down 8% this week after XYZ was added to the S&P 500 and not HOOD, which some investors were expecting.

CRCL down 20% this week after Compass Point downgraded the stock to a “Sell” rating and lowered its price target to $130.

NFLX down 3% this week, possibly based on reports that the company is using AI video tools for production from the startup Runway.

HIMS up 14% this week as the stock gained momentum amid a short-covering rally on Wednesday.

QBTS up 6% this week after B. Riley Securities raised its price target on the stock to $22.

MARA down 12% this week after the company announced a proposed private offering of $850M in zero-coupon convertible senior notes.

BE up 35% this week after the company announced its fuel cell technology will be deployed at select Oracle (ORCL) cloud infrastructure data centers in the US.

ALB up 8% this week amid reports of Chinese lithium supply cuts.

ASTS down 9% on Friday following the announcement of a $500M private offering of convertible senior notes on Thursday.

LHAI up 83% after completing its recent IPO.

Earnings Reactions

Earnings reports brought volatility to many individual stocks, with forward guidance being a significant driver of earnings reactions.

Up on Earnings

CLF up 14% this week after the company reported better-than-expected Q2 adjusted EPS results.

NOC up 8% this week after reporting robust Q2 financial results and raising its FY25 guidance.

DHI up 9% this week after the company reported better-than-expected financial results.

GEV up 9% this week after the company reported solid financial results and stated its guidance will be towards the top of the estimated range.

DECK up 13% this week after the company reported better-than-expected earnings and received several price target increases from analysts.

NEM up 6% this week after the company reported Q2 financial results and beat its adjusted EPS and revenue estimates.

VRSN up 8% this week after the company reported earnings and issued sales guidance above estimates.

Down on Earnings

QS down 8% this week as momentum slowed in the stock after the company reported financial results.

LMT down 10% this week after reporting financial results and lowering its FY25 EPS guidance.

PM down 10% this week after the company reported a Q2 sales miss.

GM down 2% this week after reporting financial results and disclosing that Q3 tariff costs could be higher than Q2.

TXN down 14% this week following the release of its Q2 financial results and forward guidance.

ENPH down 9% this week after reporting financial results and receiving several price target decreases.

DOW down 12% this week after the company reported worse-than-expected Q2 financial results and cut its dividend by 50%.

MOH down 20% this week amid mixed Q2 results and soft forward guidance.

CMG down 15% this week after the company reported worse-than-expected financial results and received mixed analyst ratings.

LUV down 8% this week after reporting lower-than-expected Q2 EPS and sales results.

CHTR down 19% this week after the company missed on earnings estimates.

INTC down 12% this week after the company reported worse-than-expected Q2 adjusted EPS results and issued Q3 guidance below estimates.

Market & Economic News

Taiwan worked on its fourth round of trade negotiations with the US this week.

Fed Chair Powell was referred to the DOJ for a potential criminal investigation regarding overspending on renovations.

A trade agreement was reached between the US and Indonesia, where the latter country will be subject to a 19% tariff.

Trump discussed the idea of eliminating capital gains taxes on home sales.

The Financial Times reported that the US and EU may be nearing a trade deal with 15% tariffs.

Trump is set to sign an order to fast-track AI projects.

Initial jobless claims data fell below forecasts, signaling strength in the US labor market.

Trump stated that he got the impression that Powell might be preparing to lower rates after the two met.

The White House reiterated that most trade deals will be done by August 1st.

Upcoming Earnings

Monday 7/28/25

NGD, CLS, EPD, WM, ARLP, CDNS, ALRS, RMBS, BOH, TLRY, PROV, NUE, RITM, EXEL

Tuesday 7/29/25

UNH, V, SOFI, MARA, PYPL, SBUX, BA, STX, UPS, BKNG, SPOT, MRK, CZR, PG, CAKE

Wednesday 7/30/25

VRT, META, MO, MSFT, HOOD, TEVA, APLD, CVNA, LRCX, VIRT, HUM, QCOM, ETSY, KGC, F, ARM, HSY, GNRC

Thursday 7/31/25

CVS, AAPL, AMZN, ABBV, MSTR, COIN, RDDT, CCJ, RIOT, ENVX, MA, NET, ROKU

Friday 8/1/25

XOM, CVX, REGN, LYB, TROW, FLR, D, CL, CNH, XHR

Upcoming Economic Events & Data

Monday 7/28/25

Dallas Fed Manufacturing Index

2-Year Note Auction

5-Year Note Auction

Treasury Refinancing Estimates

Tuesday 7/29/25

Goods Trade Balance

Retail Inventories

JOLTs Job Openings

CB Consumer Confidence

7-Year Note Auction

Wednesday 7/30/25

GDP Growth Rate QoQ

Treasury Refunding Announcement

PCE / Core PCE Prices

Pending Homes Sales

Fed Interest Rate Decision

Fed Press Conference

Thursday 7/31/25

Core PCE Price Index

Personal Income MoM

Initial / Continuing Jobless Claims

Friday 8/1/25

Non Farm Payrolls

Unemployment Rate

ISM Manufacturing PMI

Michigan 5-Year Inflation Expectations